Managing cash flow, tracking discretionary spending, and optimizing savings rates are foundational to long-term financial stability. Budgeting apps streamline these processes by automating transaction tracking, categorizing expenses, and generating actionable insights. Below is a curated list of 20 leading budgeting applications, each designed to improve financial visibility and discipline.

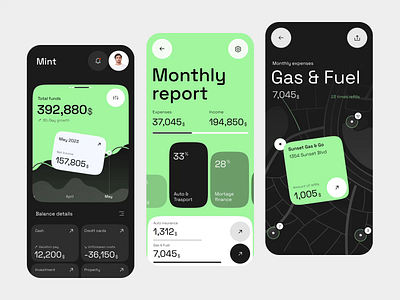

1. Mint

Mint offers automated expense tracking, bill reminders, and credit score monitoring. Its intuitive dashboard consolidates bank accounts, credit cards, and loans in one interface. Ideal for beginners seeking full-spectrum financial oversight at no cost.

2. YNAB (You Need A Budget)

YNAB applies a zero-based budgeting methodology—every dollar is assigned a purpose. It emphasizes proactive planning rather than reactive tracking. Best suited for users committed to hands-on financial management.

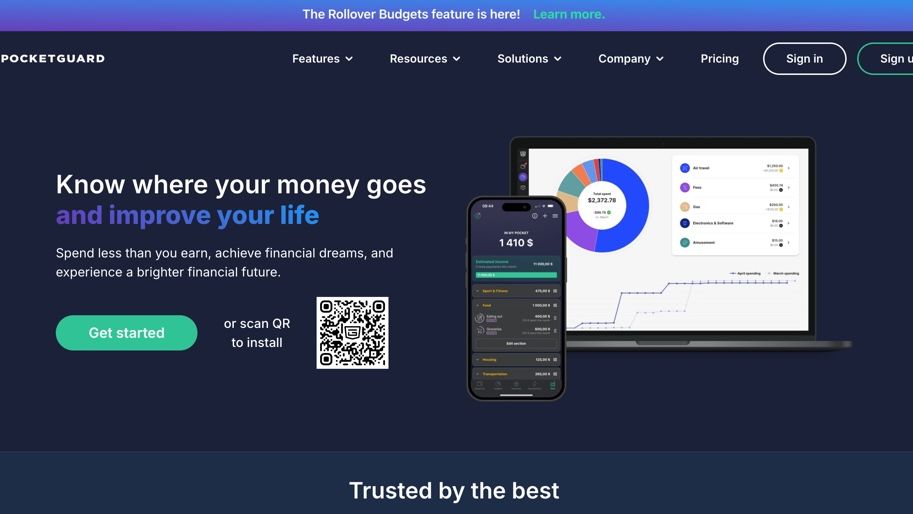

3. PocketGuard

PocketGuard simplifies budgeting by showing how much disposable income remains after obligations. Its “In My Pocket” feature prevents overspending by calculating safe-to-spend amounts in real time.

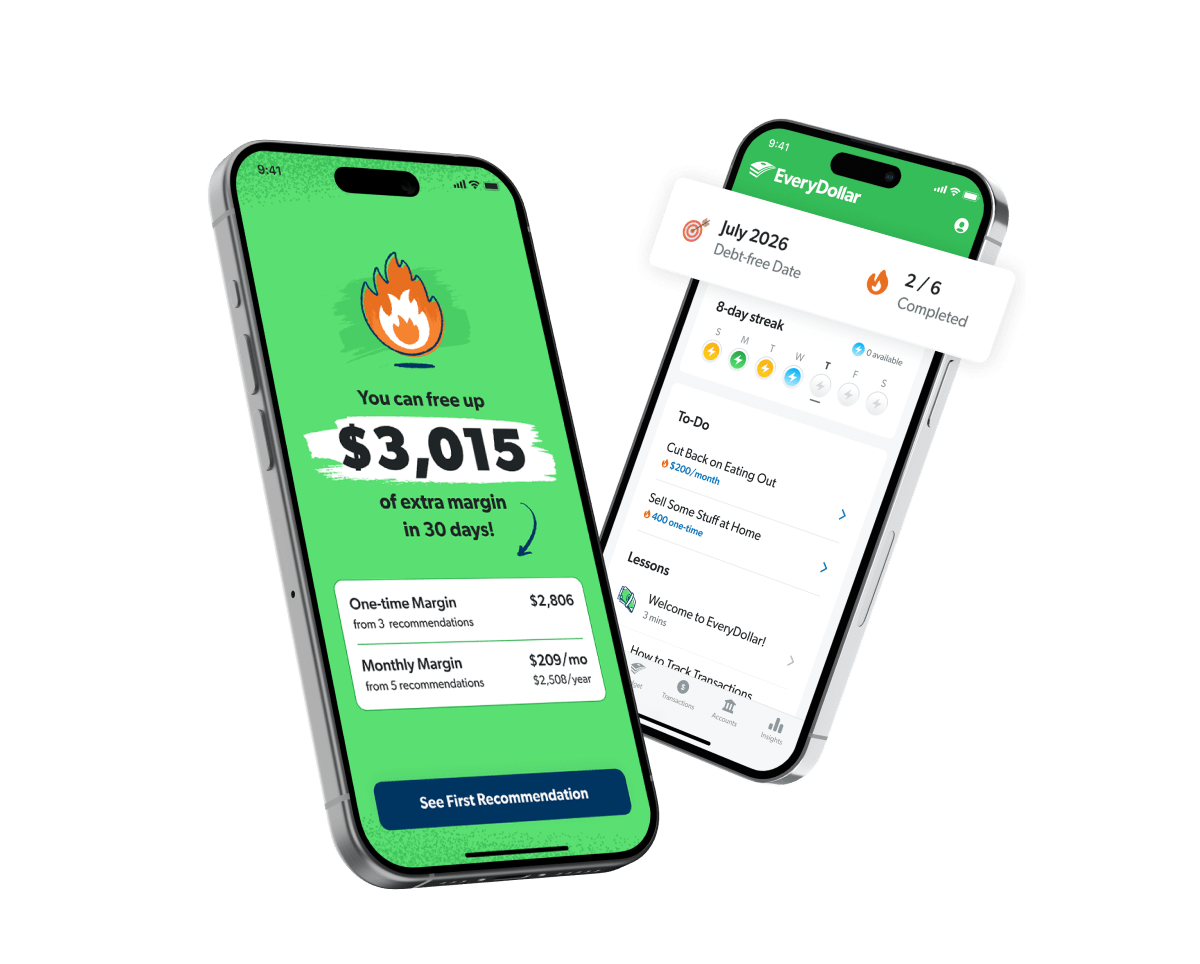

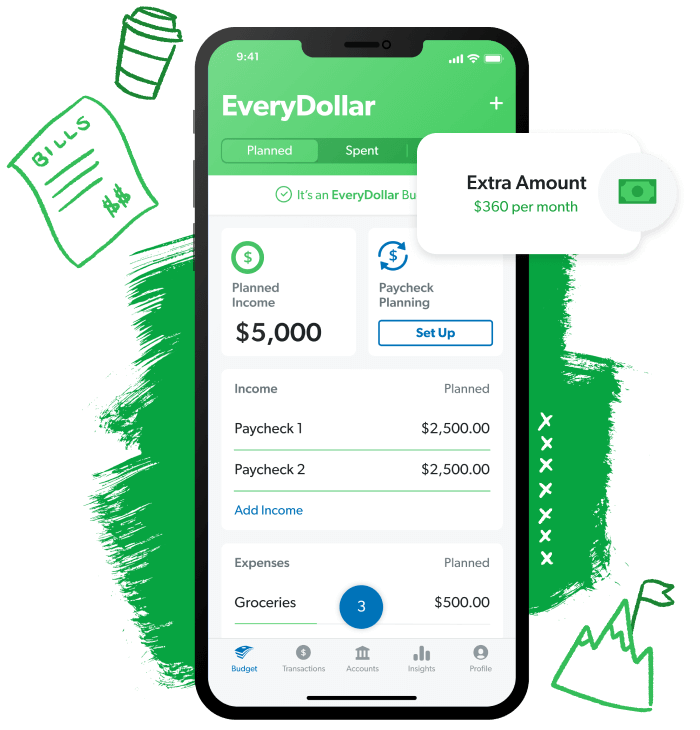

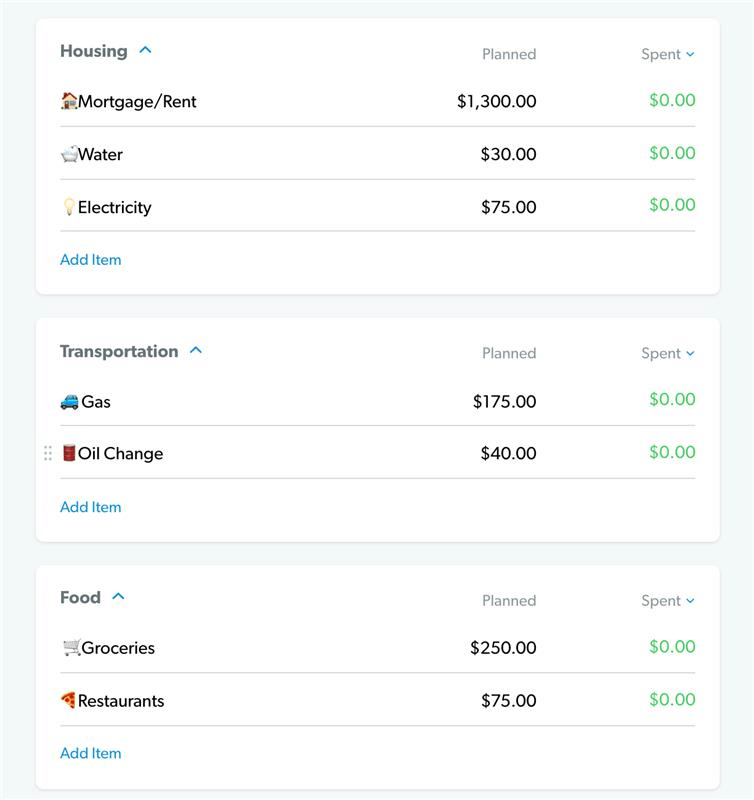

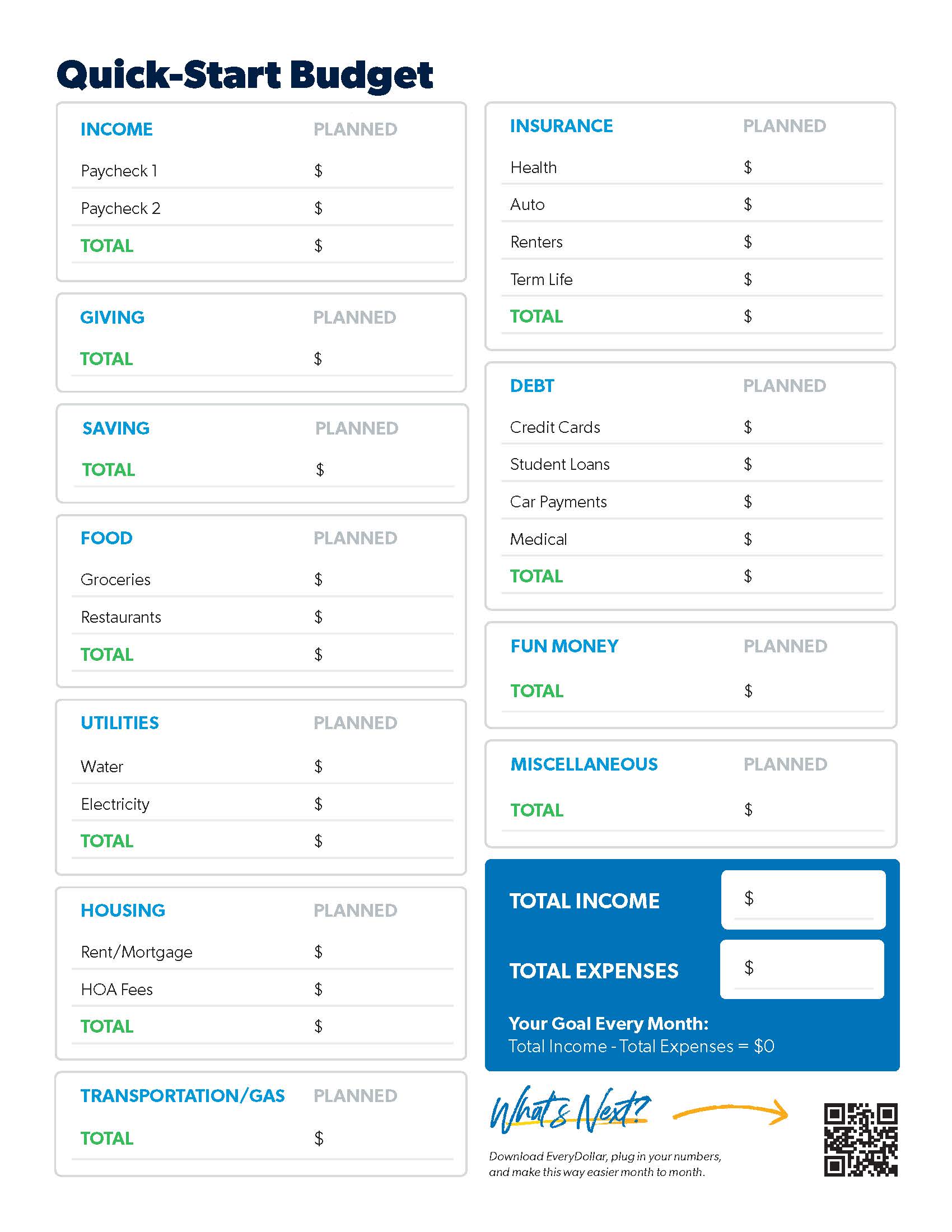

4. EveryDollar

Designed around zero-based budgeting principles, EveryDollar enables users to build monthly plans quickly. The premium version offers automatic bank syncing.

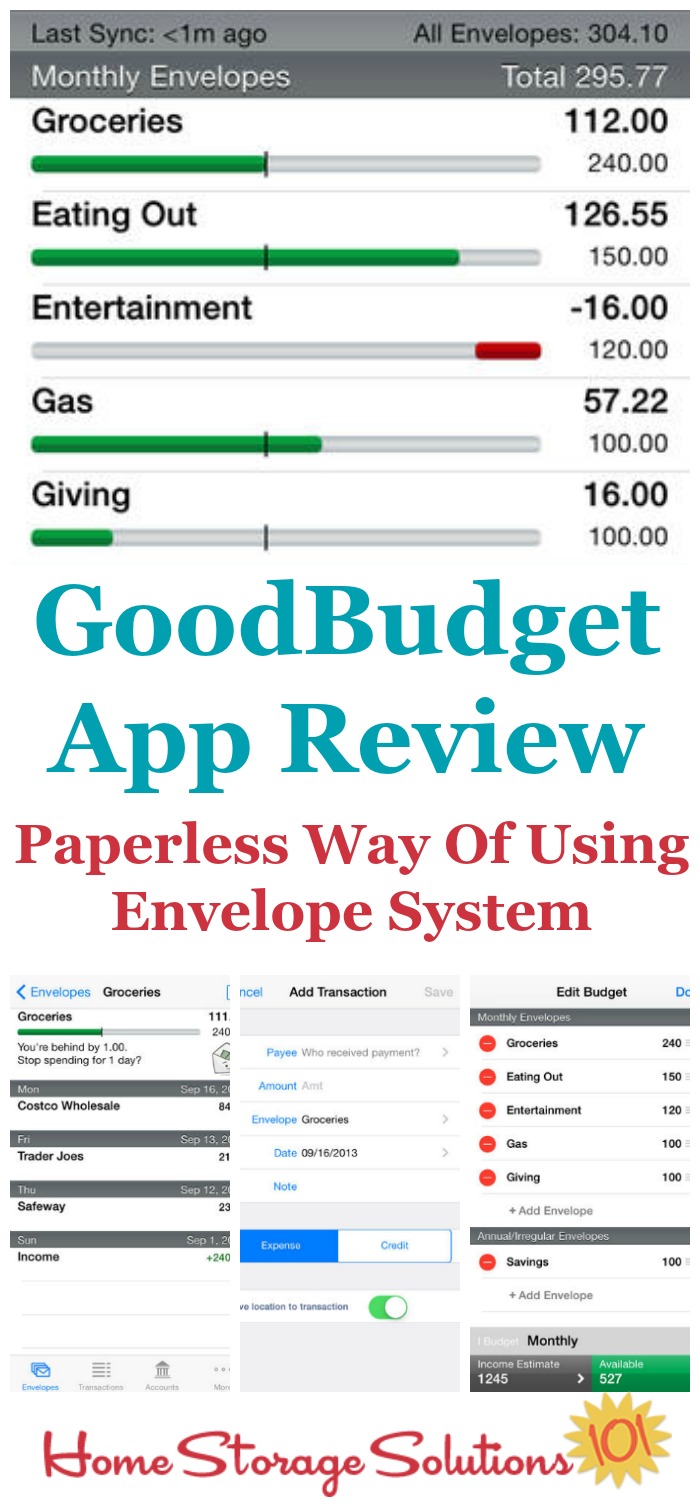

5. Goodbudget

Based on the envelope budgeting system, Goodbudget encourages disciplined allocation of funds. It is particularly useful for couples managing joint finances.

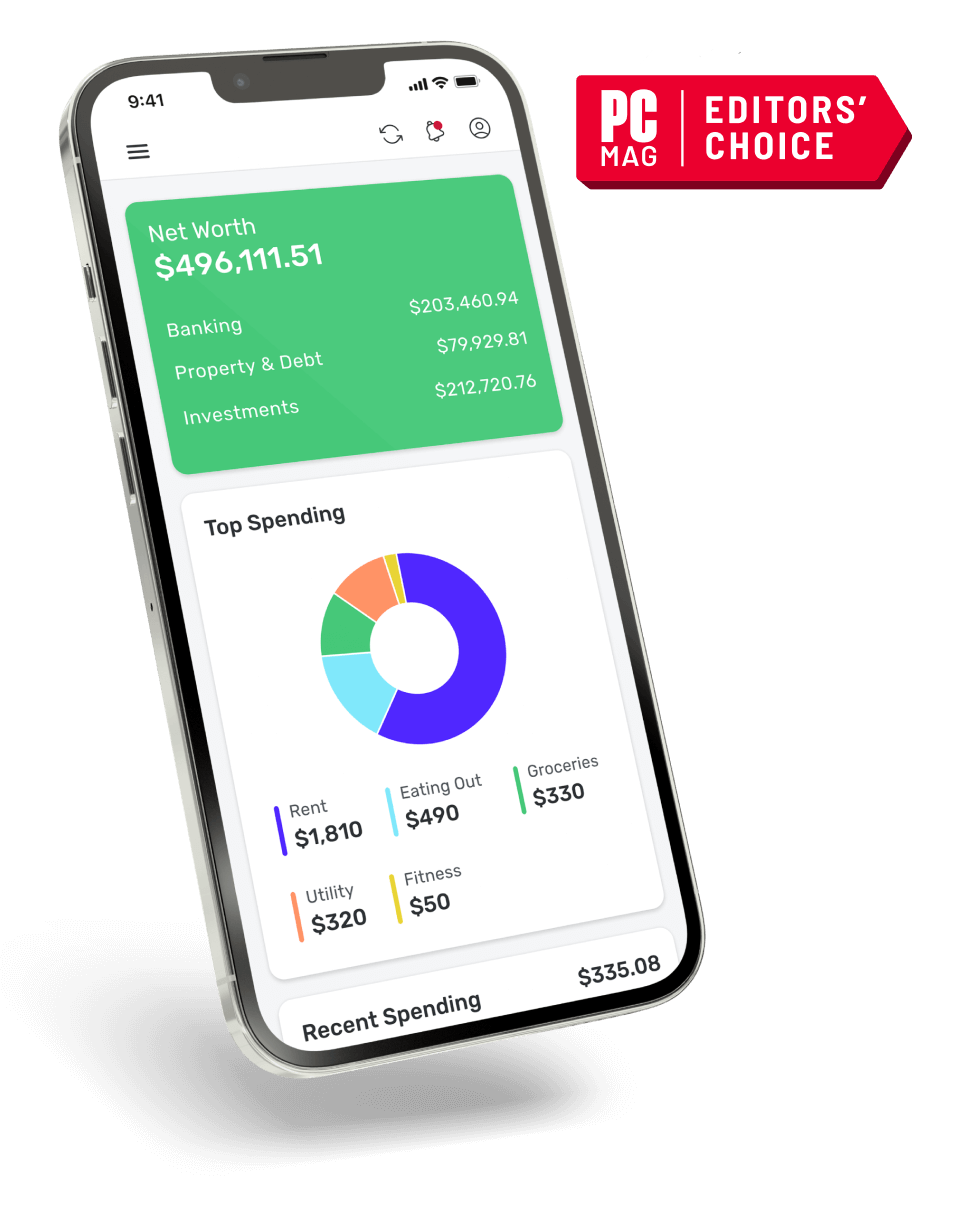

6. Personal Capital

Personal Capital combines budgeting tools with robust investment tracking. It provides portfolio analytics, retirement projections, and net-worth analysis—making it ideal for wealth-building strategies.

7. Honeydue

Honeydue focuses on couples’ finances. Users can share accounts selectively, communicate in-app, and coordinate bill payments efficiently.

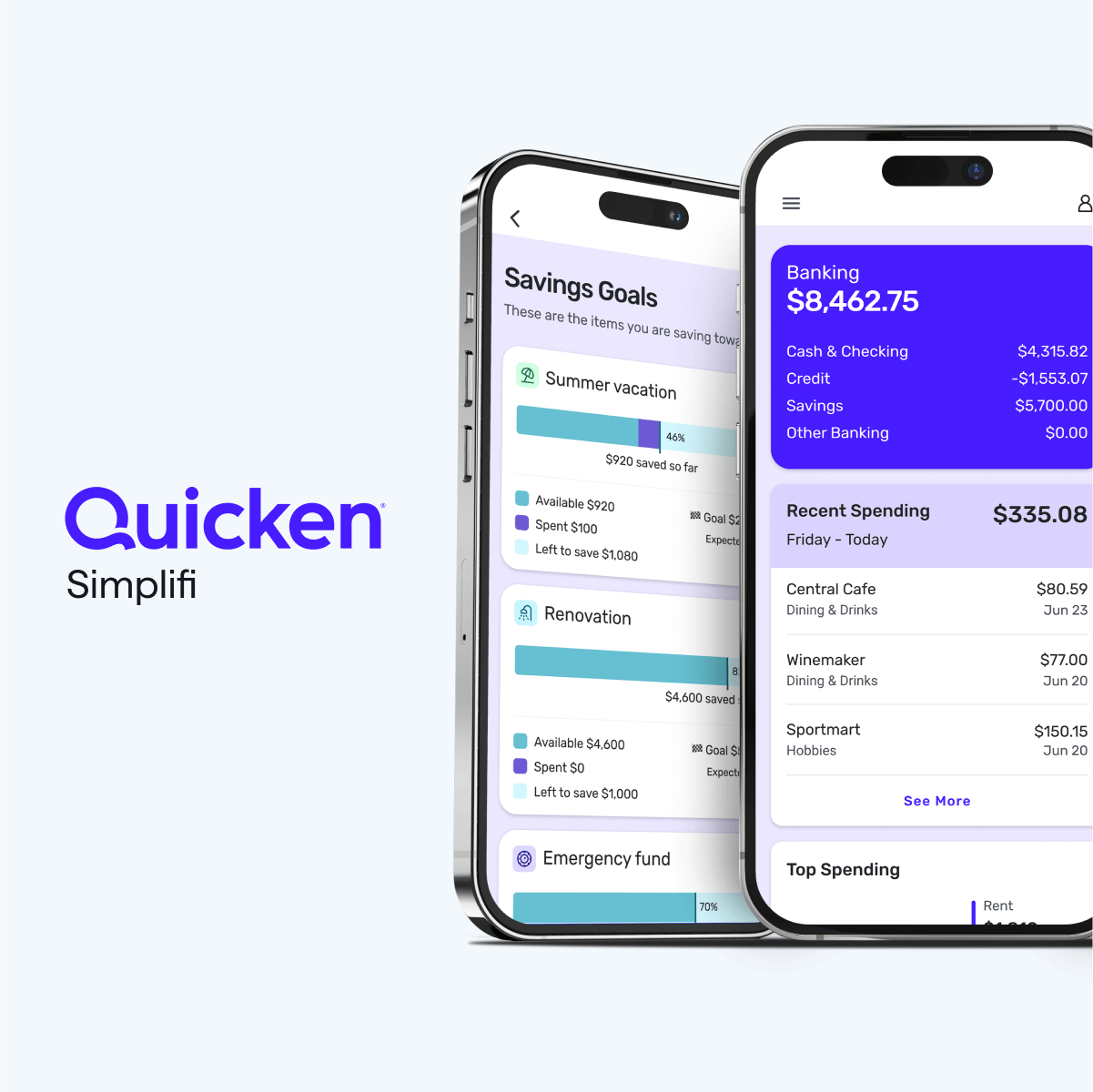

8. Simplifi

Developed by Quicken, Simplifi delivers predictive cash-flow projections. It helps users anticipate account balances and adjust spending proactively.

9. Zeta

Zeta supports shared and individual accounts for couples. Its financial planning tools include bill tracking and goal management.

10. Monefy

Monefy prioritizes simplicity. It allows quick manual expense entries and visualizes spending with pie charts for immediate clarity.

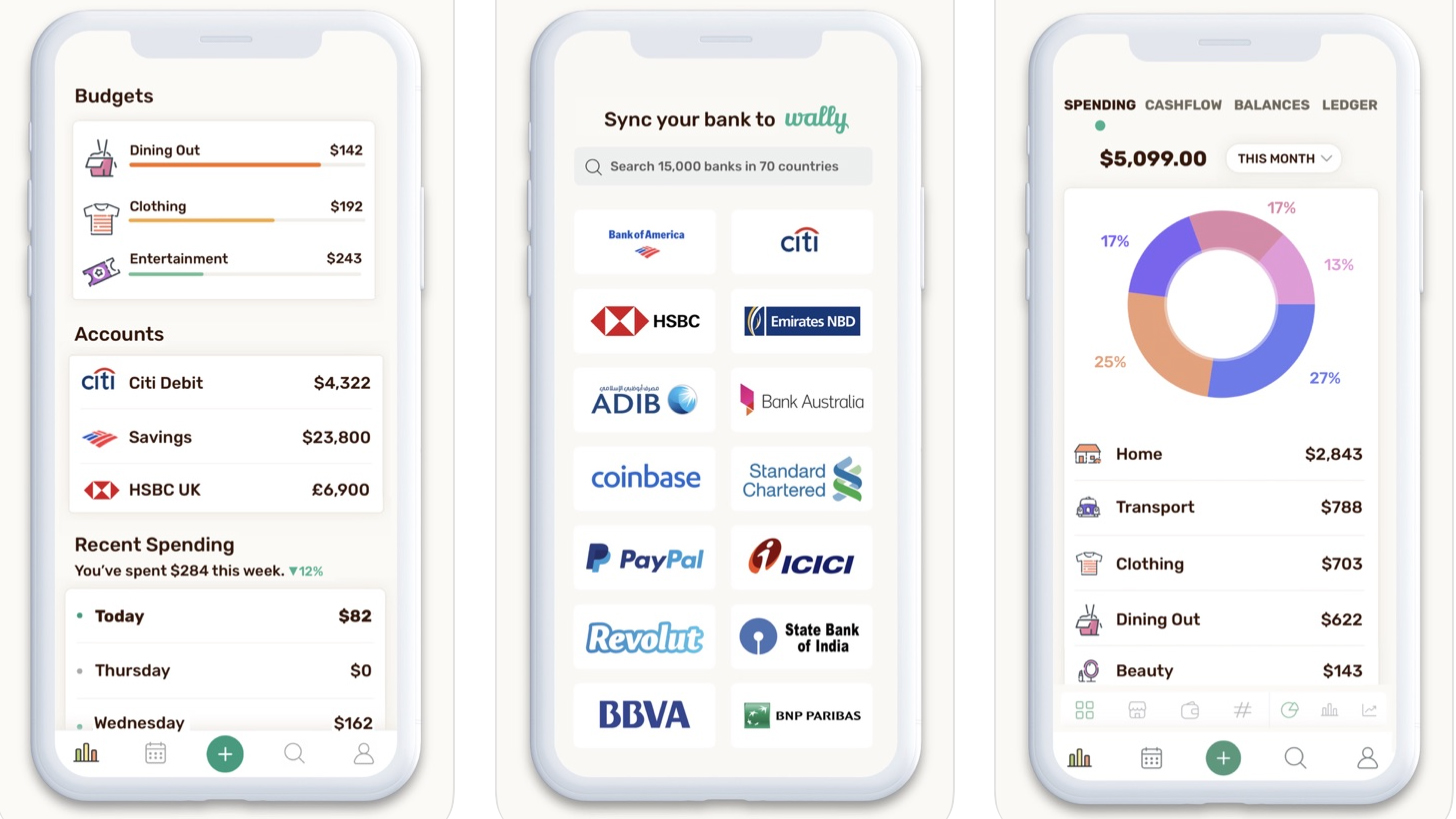

11. Wally

![]()

Wally tracks income and expenses while offering insights into spending habits. It supports multiple currencies, making it useful for international users.

12. Albert

Albert automates savings by analyzing spending behavior. It also provides basic investing features and financial guidance.

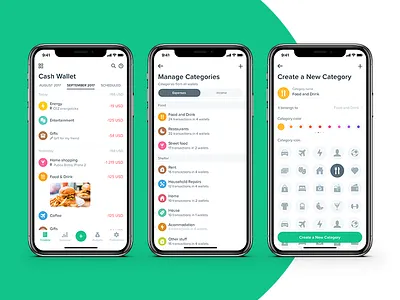

13. Spendee

Spendee offers shared wallets, making collaborative budgeting straightforward. It integrates with bank accounts and digital wallets.

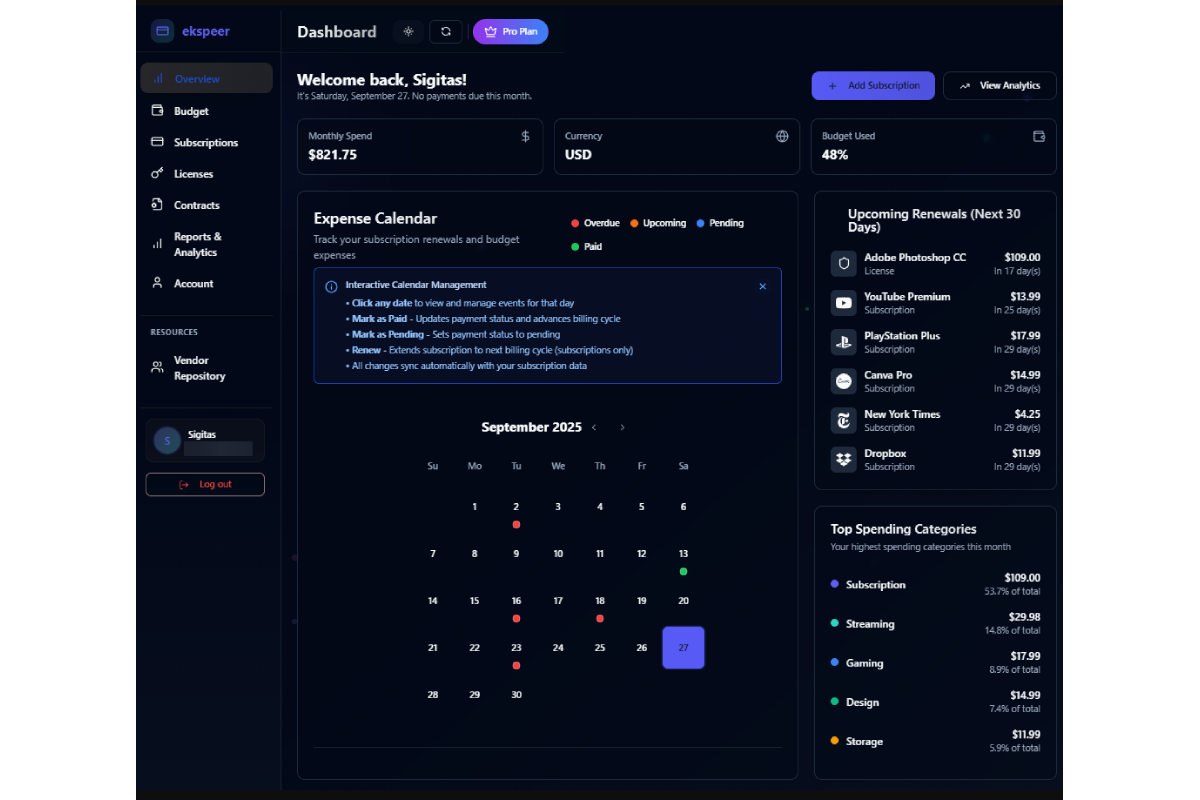

14. Clarity Money

Clarity Money specializes in subscription tracking and expense monitoring, helping users eliminate unnecessary recurring costs.

15. CountAbout

CountAbout supports data import from other financial software. It offers customizable categories and detailed reporting.

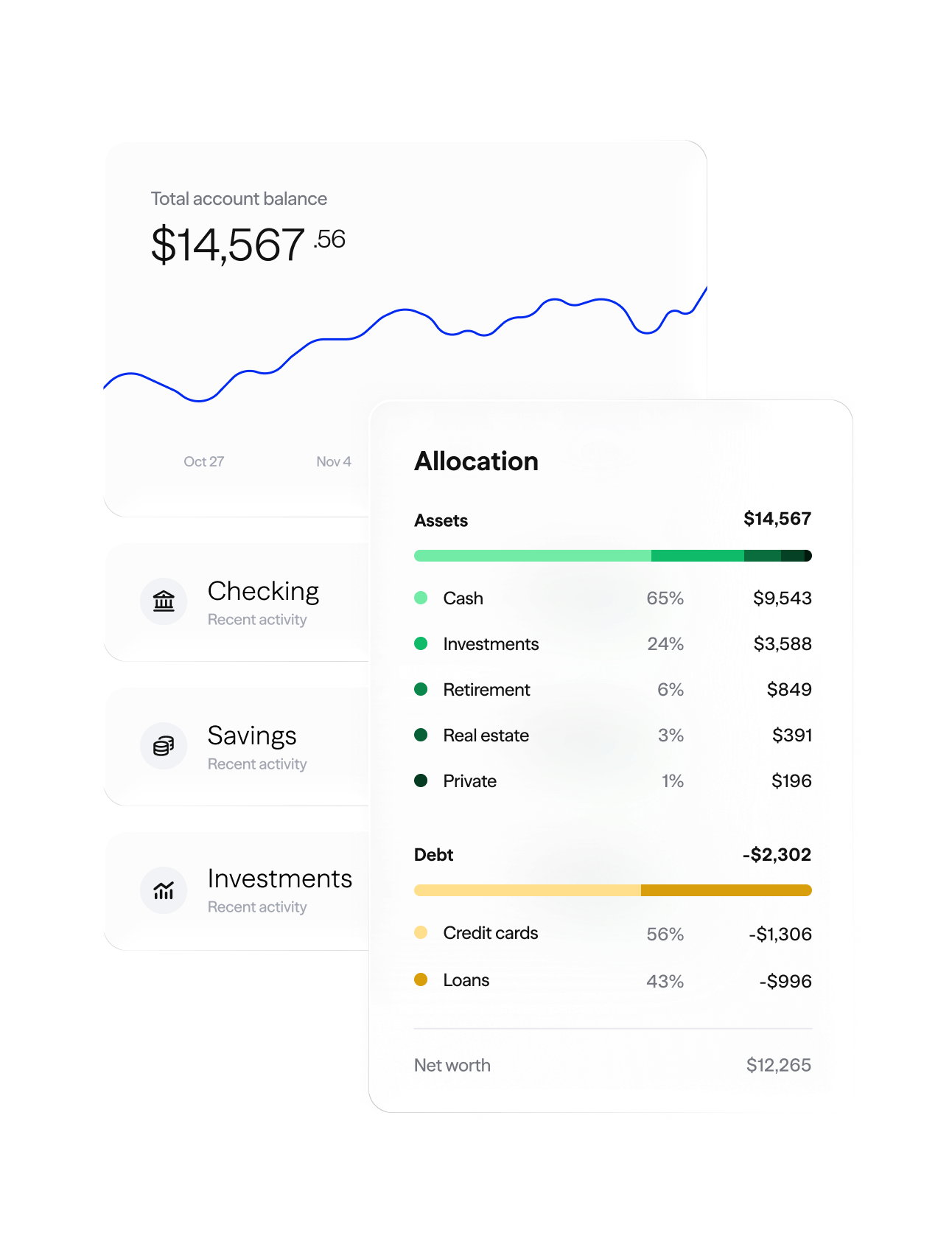

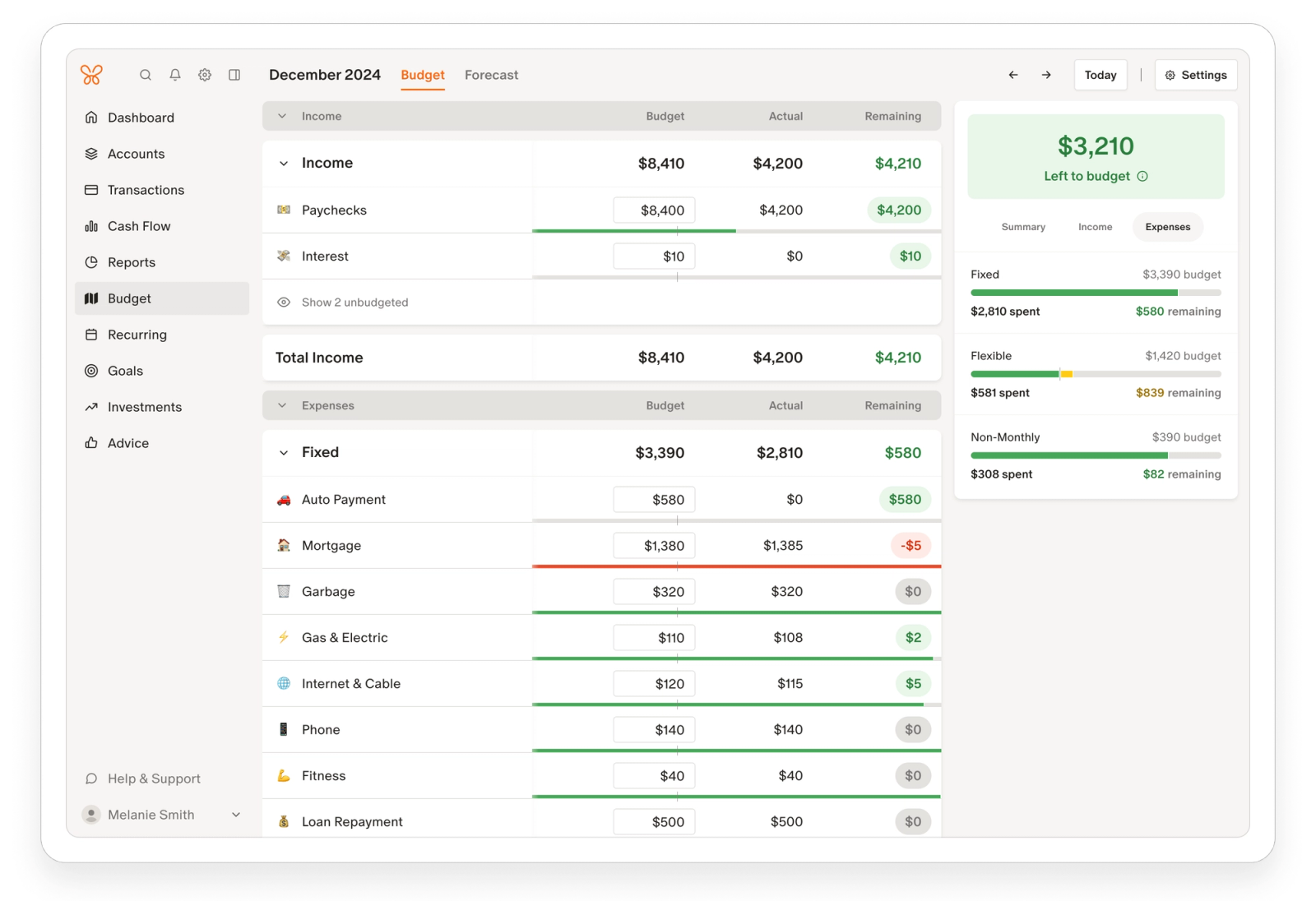

16. Monarch Money

Monarch Money combines budgeting, goal tracking, and investment monitoring into one cohesive platform, appealing to households seeking integrated planning.

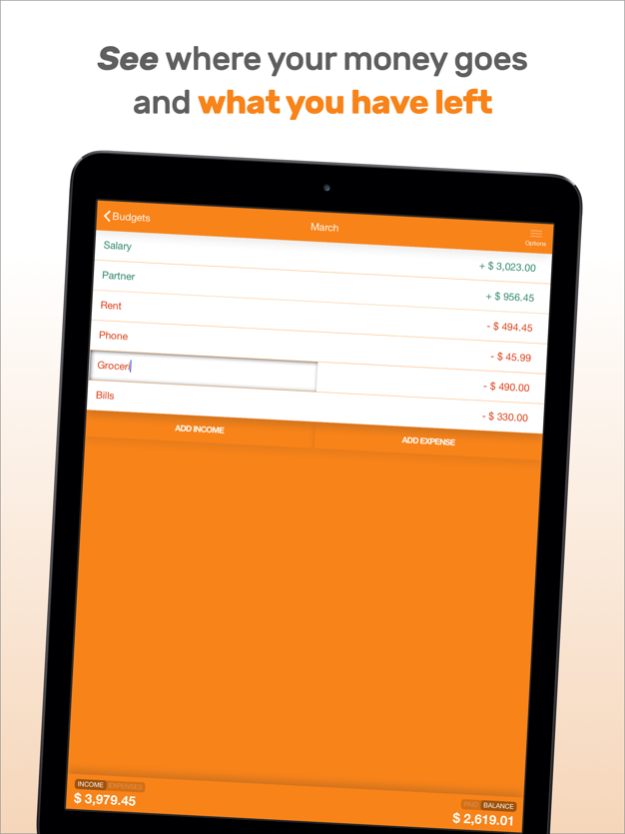

17. Fudget

Fudget is minimalist by design. Users manually input income and expenses, promoting awareness through deliberate tracking.

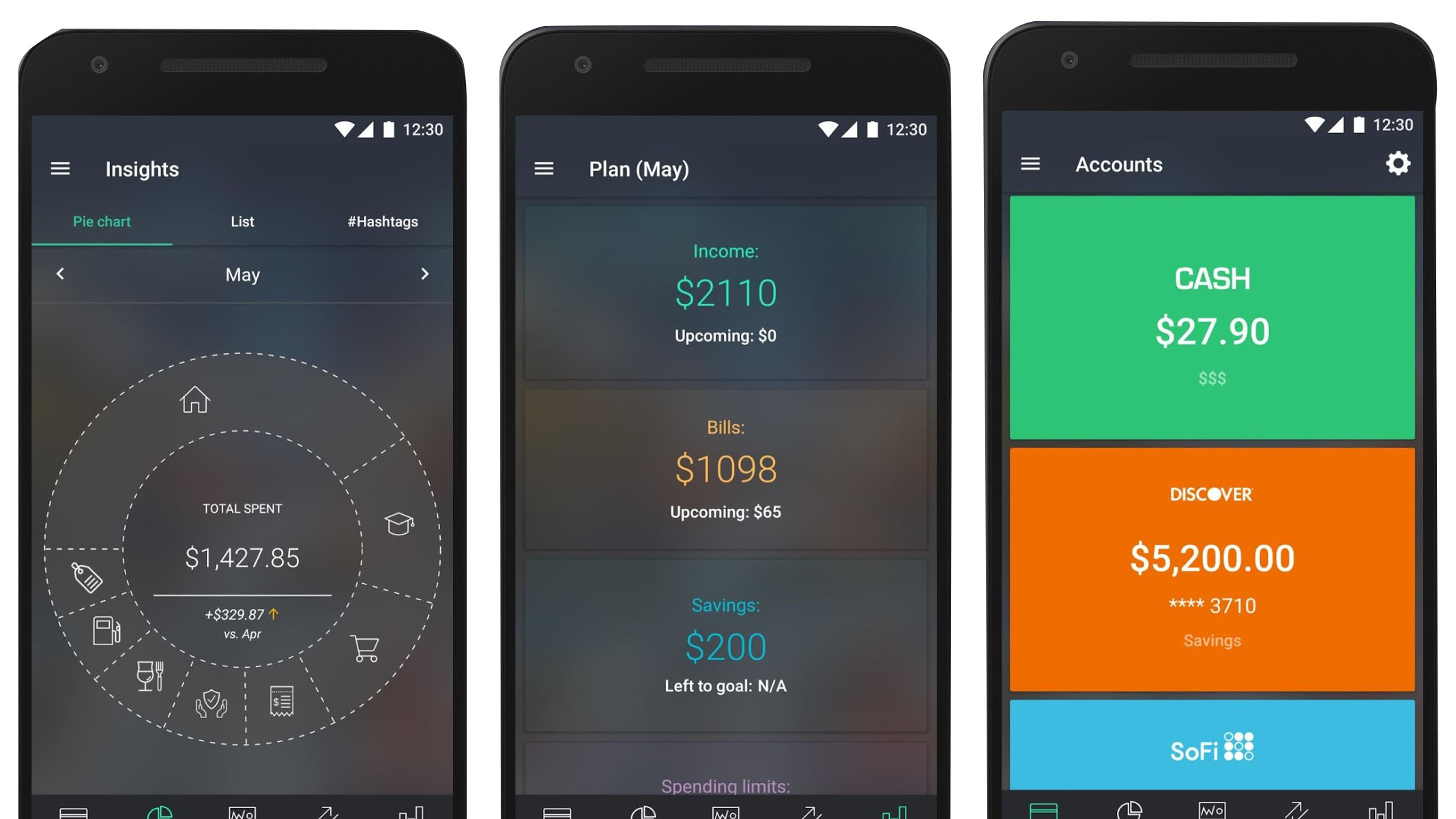

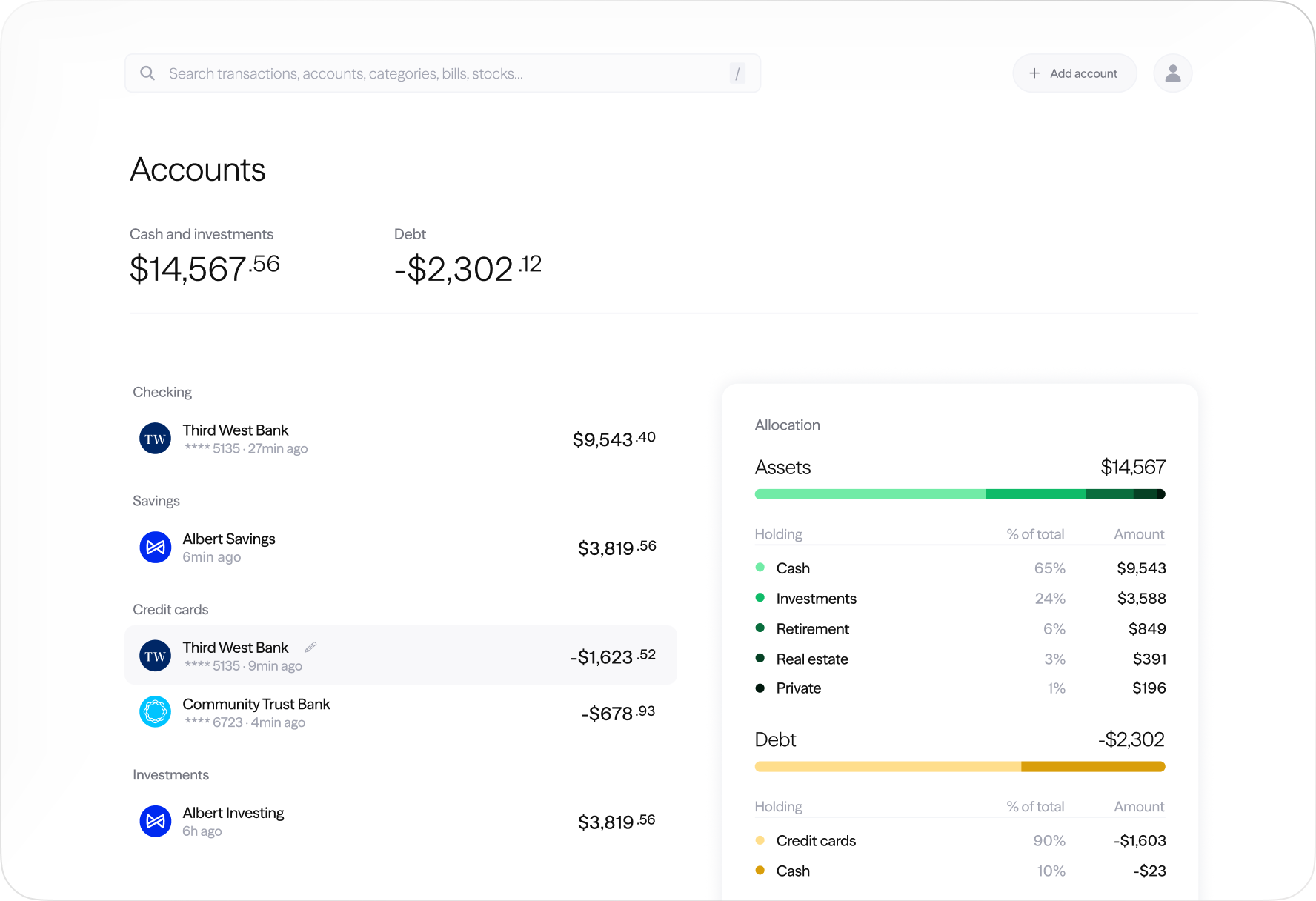

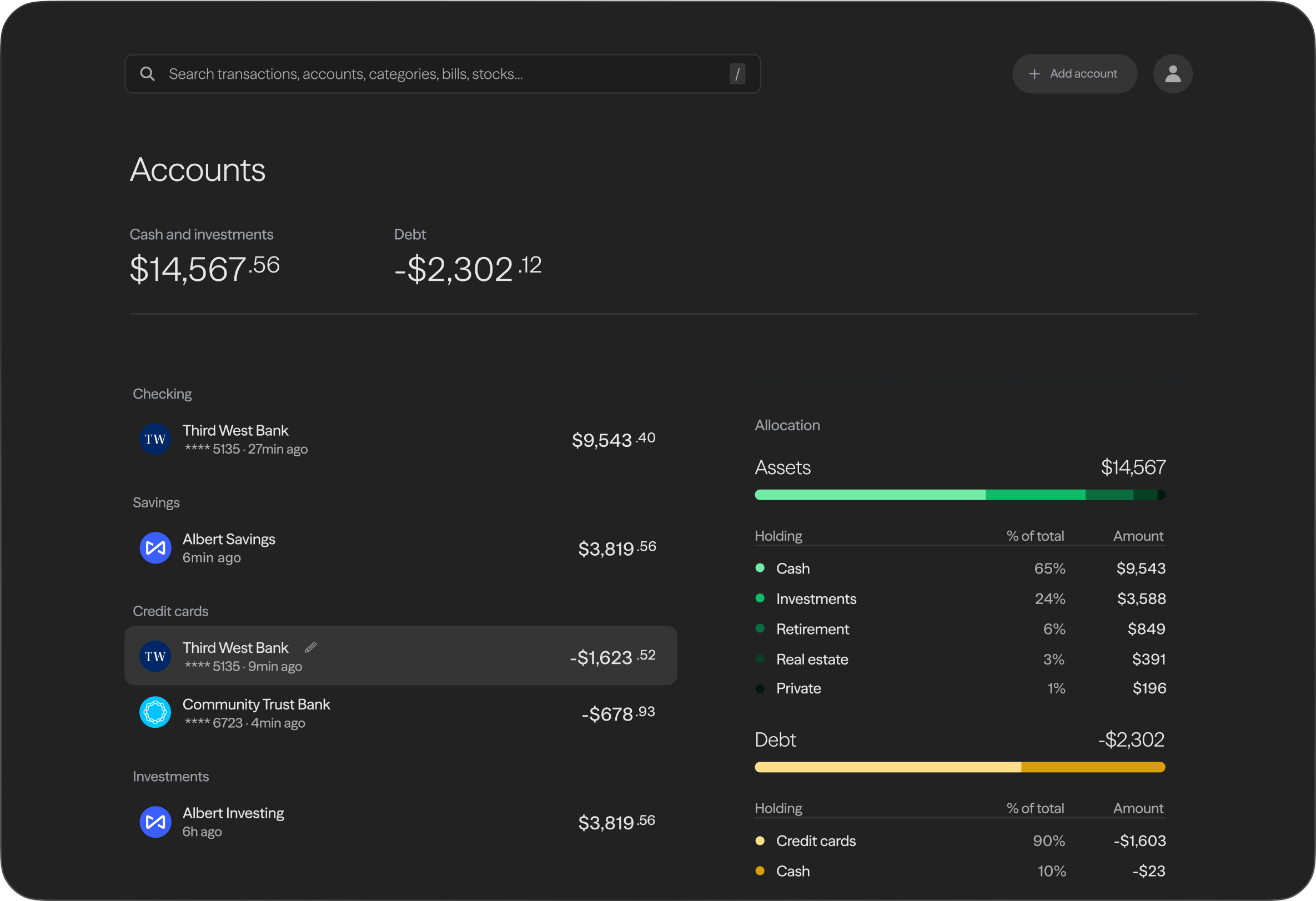

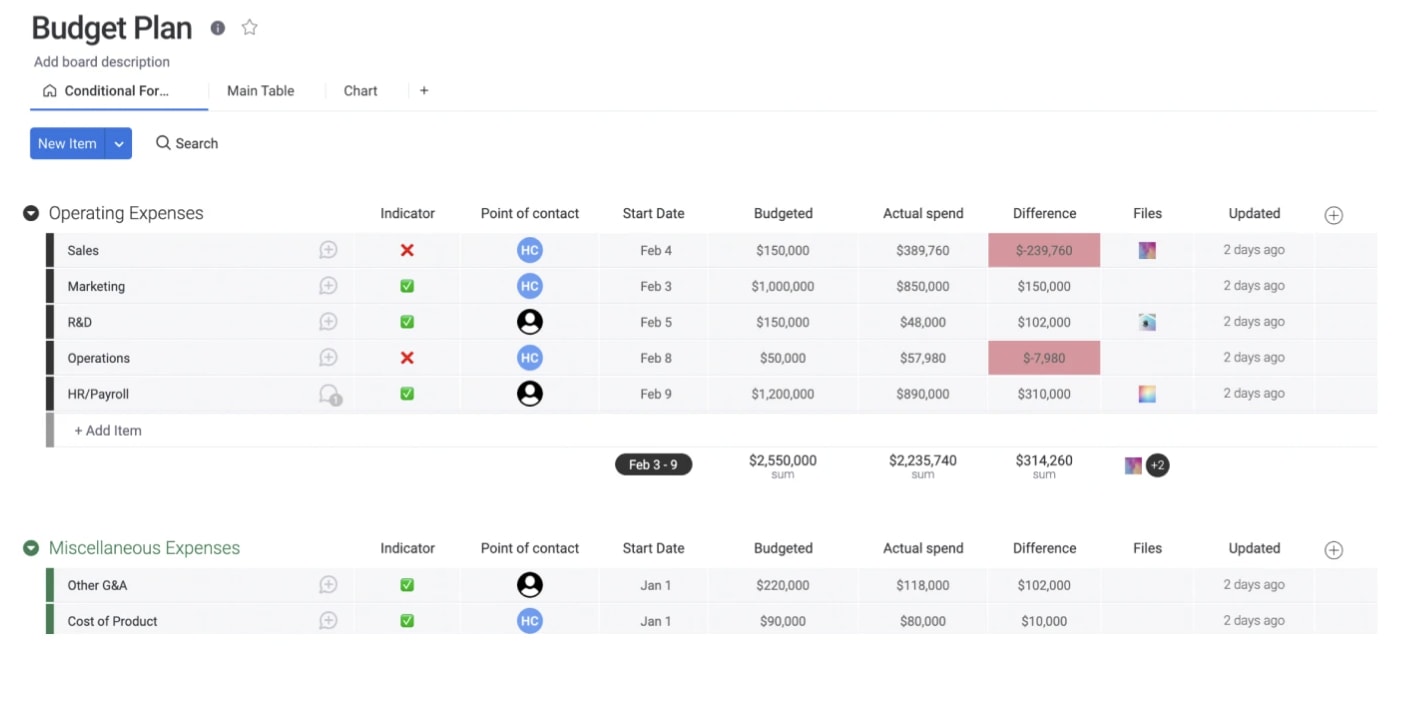

18. Money Manager

![]()

Money Manager delivers comprehensive expense tracking with graphical reports and account management features.

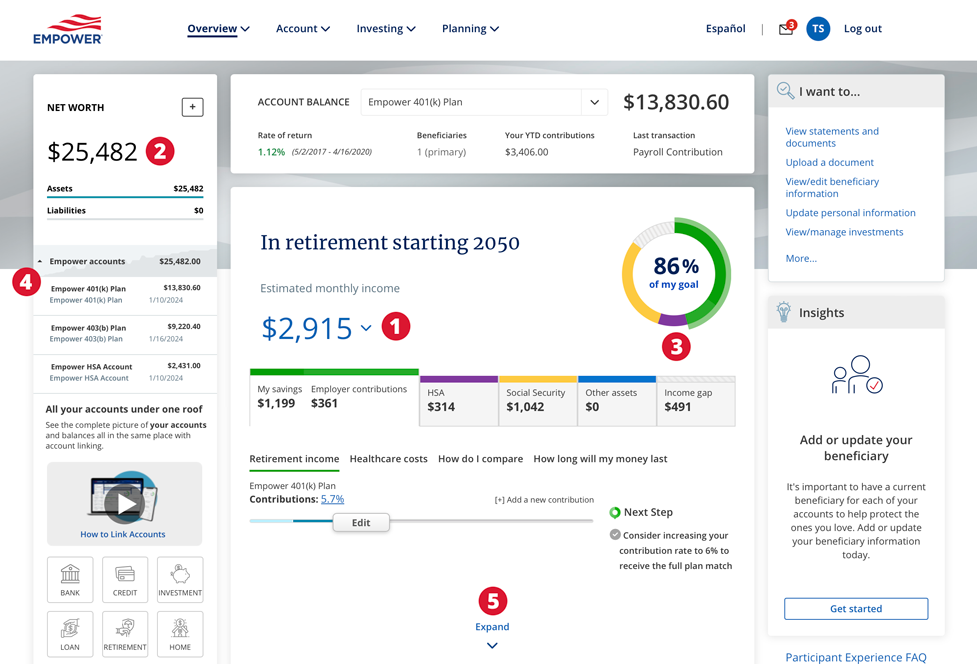

19. Empower

Empower provides budgeting tools alongside retirement planning services, making it valuable for long-term financial architecture.

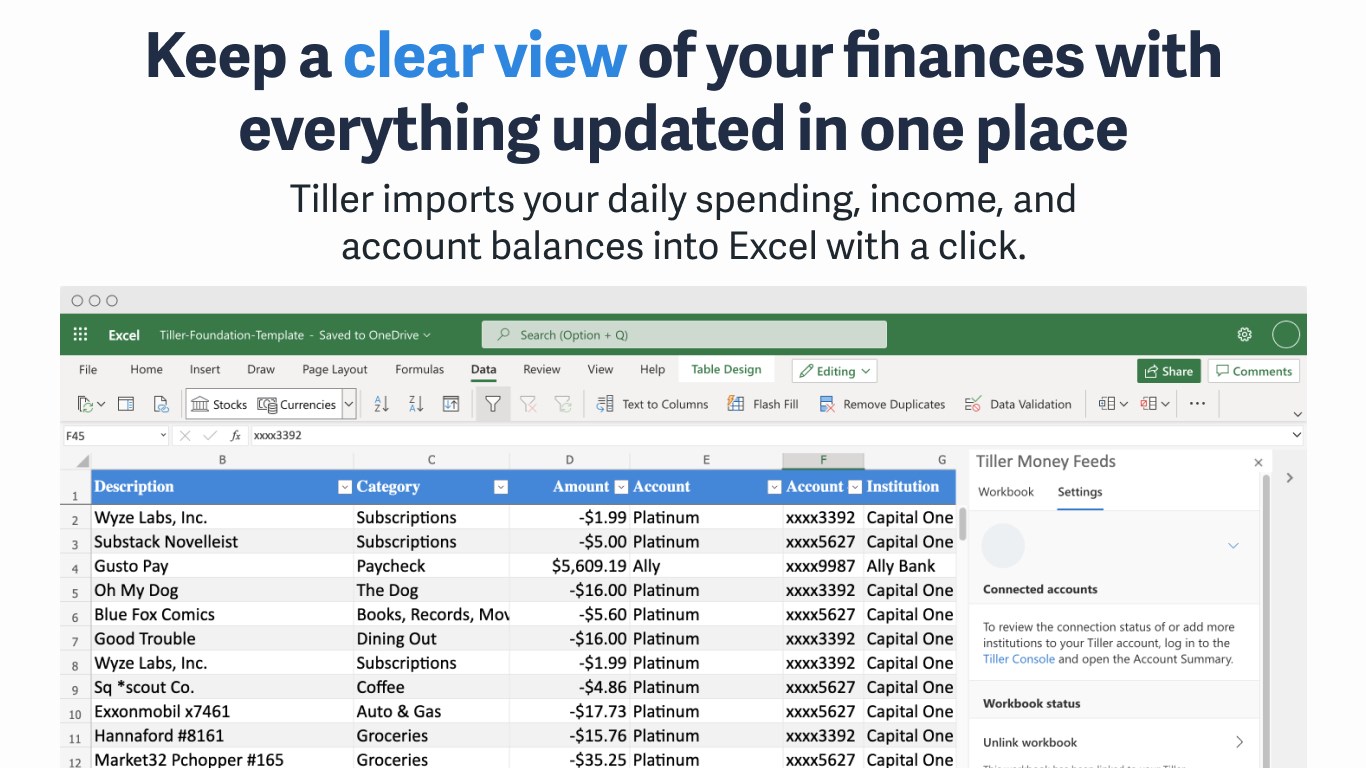

20. Tiller

Tiller integrates directly with spreadsheets, automatically importing financial data into Google Sheets or Excel. Ideal for users who prefer granular control and custom financial modeling.

Selecting a budgeting app depends on financial complexity, desired automation level, and behavioral discipline. Zero-based budgeting platforms like YNAB and EveryDollar are optimal for structured allocation strategies. Automated trackers like Mint or PocketGuard reduce manual workload. Spreadsheet-based tools such as Tiller serve analytically inclined users.

Regardless of the platform chosen, consistent engagement is the decisive variable. Budgeting apps are tools; financial transformation results from disciplined execution.

0 Comments